What has happened: Four Labour Codes become effective

On 21 November 2025, the Code on Wages, 2019, Industrial Relations Code, 2020, Code on Social Security, 2020 and Occupational Safety, Health and Working Conditions Code, 2020 (together the “Labour Codes”) were brought into force, replacing or consolidating 29 existing central labour laws.

The objectives: simplify compliance, modernise labour-relations, widen worker protections (including gig/platform workers), and support ease-of-doing-business.

Applicability and eligibility – what it means for your business

Who is covered?

– These Codes apply to all establishments covered under central labour law – organised, unorganised, gig and platform workers. For example, the Code on Social Security explicitly covers gig & platform workers.

– For businesses, the key point: even smaller enterprises will need to assess their compliance, especially if they engage contract labour, have employees, or operate across states. The legacy state-shop & establishment laws will continue in parallel until states align.

When did changes take effect?

– The major notifications were effective from 21 November 2025.

– Some parts of the Codes (rules, schemes, state implementations) are still being notified — so you are likely to operate in a hybrid regime for a while.

Key implications for businesses – what you must act on

Here’s a checklist of practical action items and implications:

|

Area |

What’s changed |

What you should do |

|

Wage structure & benefits |

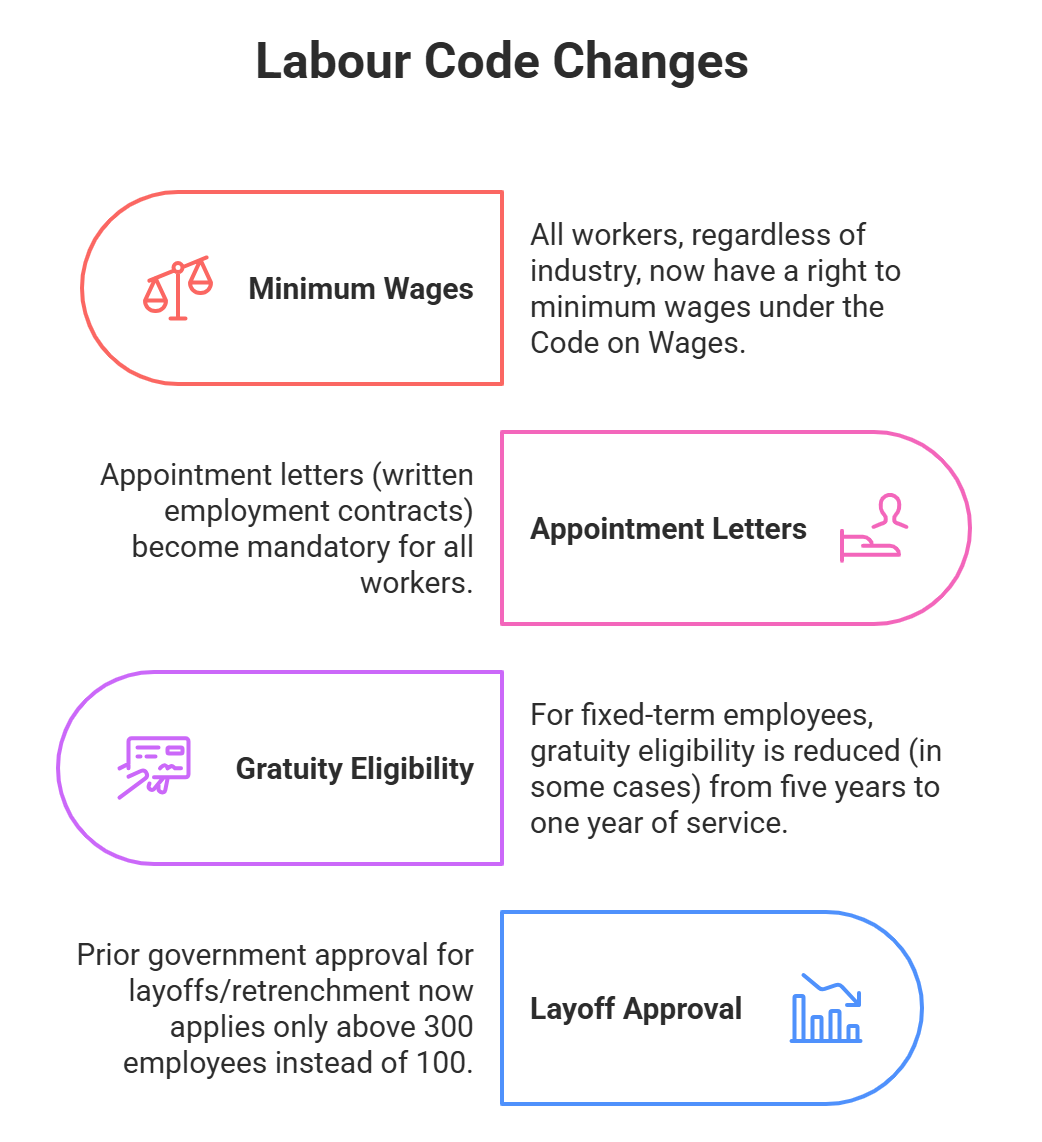

Definition of “wages” broadened; minimum wage floor applies to all workers. |

Review your salary components (basic + allowances) and ensure that wage structure aligns (especially if you use perks/allowances to optimise cost). |

|

Appointment & contracts |

Written appointment letter mandatory for all workers. |

Draft standard appointment letters mentioning designation, wages, social-security entitlements. Apply to all new hires and bring existing hires in line. |

|

Social security & gig/platform workers |

Extends coverage to gig, platform and contract workers; portability of benefits. |

If you engage freelancers, contract, gig or platform-workers, map them: do they fall under “workers” definition? Ensure social-security compliance (or plan for it) and flag exposure. |

|

Working hours, overtime & safety |

Daily working hours now flexible up to 12 hrs (but capped at 48/week); overtime must be paid at least double rate. |

Review shift schedules, overtime policies. Update HR systems for overtime calculations. Ensure time-tracking is compliant. |

|

Women, night shifts & equality |

Women allowed for night shifts (with consent + safety). Equal pay for equal work emphasised. |

If you have operations involving night-shifts or women workers in such roles, update policies: obtain consent, ensure safety infrastructure, check pay parity. |

|

Compliance & registers |

Employers must maintain registers, facilities (canteen, restrooms, water), free annual health checks for certain categories. |

Audit your HR and facility infrastructure: are you maintaining required registers? Do you have facilities for welfare? Plan for free annual health check-ups for eligible staff. |

|

Transition & overlapping laws |

State-level shop & establishment laws remain; some central rules pending notification. |

Maintain dual-compliance: continue meeting state laws until they are subsumed. Track which rules are yet to be notified. Set up a transition roadmap. |

In summary, the new labour codes mark a decisive shift toward a more structured, transparent, and business-friendly compliance environment. For businesses, this is the right time to recalibrate HR policies, employment documentation, and payroll structures so that you stay ahead of regulatory expectations. A planned transition now will help you avoid future disputes, minimise compliance risk, and build a stronger, more employee-centric organisation.