For too long, internal audit was often seen as a reactive compliance function, a necessary evil, or simply a box-ticking exercise. However, in today’s dynamic Indian business landscape, with its rapidly evolving regulatory environment, technological advancements, and increasing complexities, that approach simply won’t suffice. The modern internal audit professional needs to be a strategic partner, a foresight expert, and a guardian of value.

This transformation is driven by the imperative of Risk-Based Internal Auditing (RBIA).

Forget auditing everything; the smart auditor focuses their precious time and resources where they matter most – on the risks that truly threaten the organization’s objectives.

This guide will walk you through building a robust RBIA plan, with a keen eye on internal controls and practical application for Indian organizations.

Why RBIA is Your New Best Friend (and the Organization’s Too!)

Imagine a security guard trying to protect a sprawling complex by patrolling every single inch with equal intensity. It’s inefficient and misses the critical hotspots. Now imagine that same guard, armed with intelligence, focusing on the high-risk areas – the main vault, the server room, the key access points. That’s the power of RBIA.

For Indian organizations, RBIA offers immense advantages:

- Optimized Resource Allocation: No more wasted effort on low-risk areas. Your team focuses on what truly impacts the business.

- Proactive Risk Mitigation: Identify and address potential issues before they escalate into full-blown crises.

- Enhanced Strategic Alignment: Directly link audit efforts to the organization’s strategic objectives and risk appetite.

- Improved Decision Making: Provide management and the Board with insightful, risk-focused assurance that drives better decisions.

- Compliance with Evolving Standards: Increasingly, Indian regulatory bodies and best practice frameworks (like the ICAI guidelines and Companies Act, 2013) emphasize a risk-based approach.

The Foundation: Understanding Internal Controls

Before you can audit risks, you need to understand how they are being managed. This is where internal controls come in. Think of internal controls as the safeguards and checks within an organization designed to ensure the reliability of financial reporting, compliance with laws and regulations, and the effectiveness and efficiency of operations.

In India, the Companies Act, 2013, particularly Section 134 and 143, has put a significant spotlight on the adequacy and effectiveness of Internal Financial Controls (IFCs). While the COSO Framework (Committee of Sponsoring Organizations of the Treadway Commission) is globally recognized and widely adopted by Indian corporates as a de facto standard, it’s crucial to tailor its principles to the specific context of your organization.

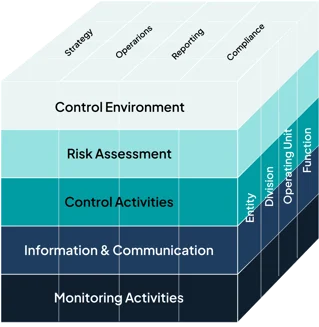

The Five Interrelated Components of COSO (and how they apply to you):

- Control Environment: This sets the tone at the top. Is there a strong ethical culture? Do management and the Board demonstrate commitment to internal controls? Practical Tip: Look for clear communication from leadership, a code of conduct, and robust whistleblowing mechanisms.

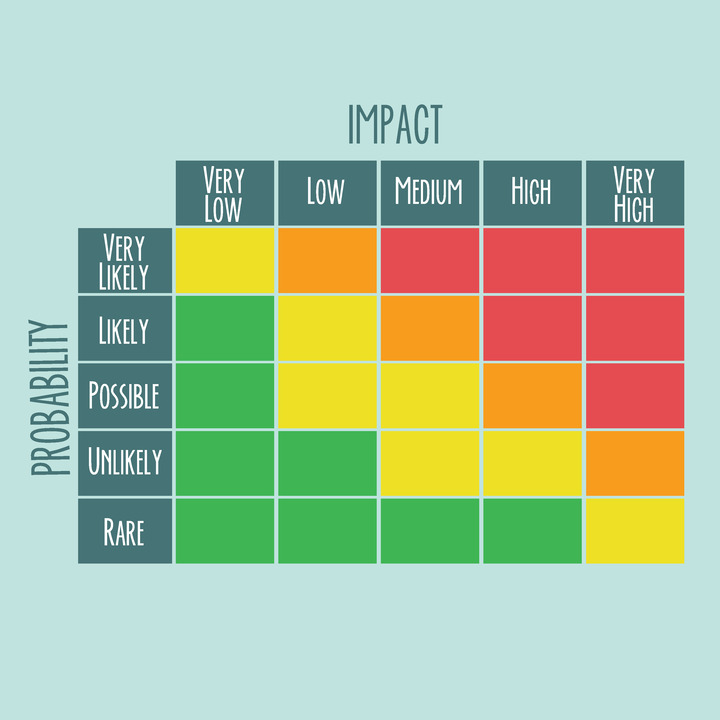

- Risk Assessment: The process of identifying, analyzing, and managing risks to achieving objectives. This is the bedrock of RBIA, and we’ll dive deeper into it.

- Control Activities: The actions taken to mitigate risks. These can be preventive (e.g., segregation of duties) or detective (e.g., reconciliations). Practical Tip: Document key control activities, especially in high-risk processes, and ensure they are well-defined and regularly performed.

- Information and Communication: How relevant information is identified, captured, and communicated in a timely manner. Practical Tip: Assess communication channels, reporting structures, and the quality of data used for decision-making.

- Monitoring Activities: Ongoing evaluations to determine if the internal controls are functioning as intended. This includes ongoing management activities, separate evaluations, and internal audit. Practical Tip: Your RBIA plan itself is a crucial monitoring activity!

The “How-To” of Building Your Risk-Based Internal Audit Plan

Here’s a step-by-step tutorial to craft an engaging and impactful RBIA plan for your Indian organization:

Building a risk-based internal audit plan isn’t just a best practice; it’s a strategic imperative for Indian organizations aiming for sustained growth and resilience. By systematically identifying, assessing, and prioritizing risks, and by diligently evaluating the effectiveness of internal controls, organizations gain a powerful foresight mechanism.

This approach transforms internal audit from a traditional compliance function into a true value-adding partner. It ensures that audit resources are precisely aligned with the most significant threats to the organization’s objectives.