Internal audit can no longer afford to rely solely on sample-based, retrospective reviews. With rising expectations from Audit Committees, CFOs, and regulators, Data Analytics in Internal Audit is no longer optional—it’s essential. Today’s internal audit functions must evolve into proactive, insight-driven advisors. That means moving beyond traditional methods and embracing Internal Audit Analytics, Predictive Risk modeling, and Continuous Auditing powered by modern Audit Technology.

This article explores how internal auditors can harness Big Data Audit capabilities to transform risk detection. We’ll look at how analytics enables 100% transaction testing, real-time anomaly detection, and predictive insights that help organizations stay ahead of emerging threats. You’ll learn how to shift from reactive assurance to continuous, data-driven monitoring. We’ll also cover practical strategies for implementing predictive models, automating control testing, and using AI to uncover hidden fraud patterns.

Whether you’re an internal auditor, Audit Committee member, risk professional, or CFO, this guide will show you how to turn data into a strategic asset. Let’s explore how Data Analytics in Audit can elevate your function from compliance checker to a true partner in enterprise risk management and performance improvement.

TL;DR – Quick Takeaways

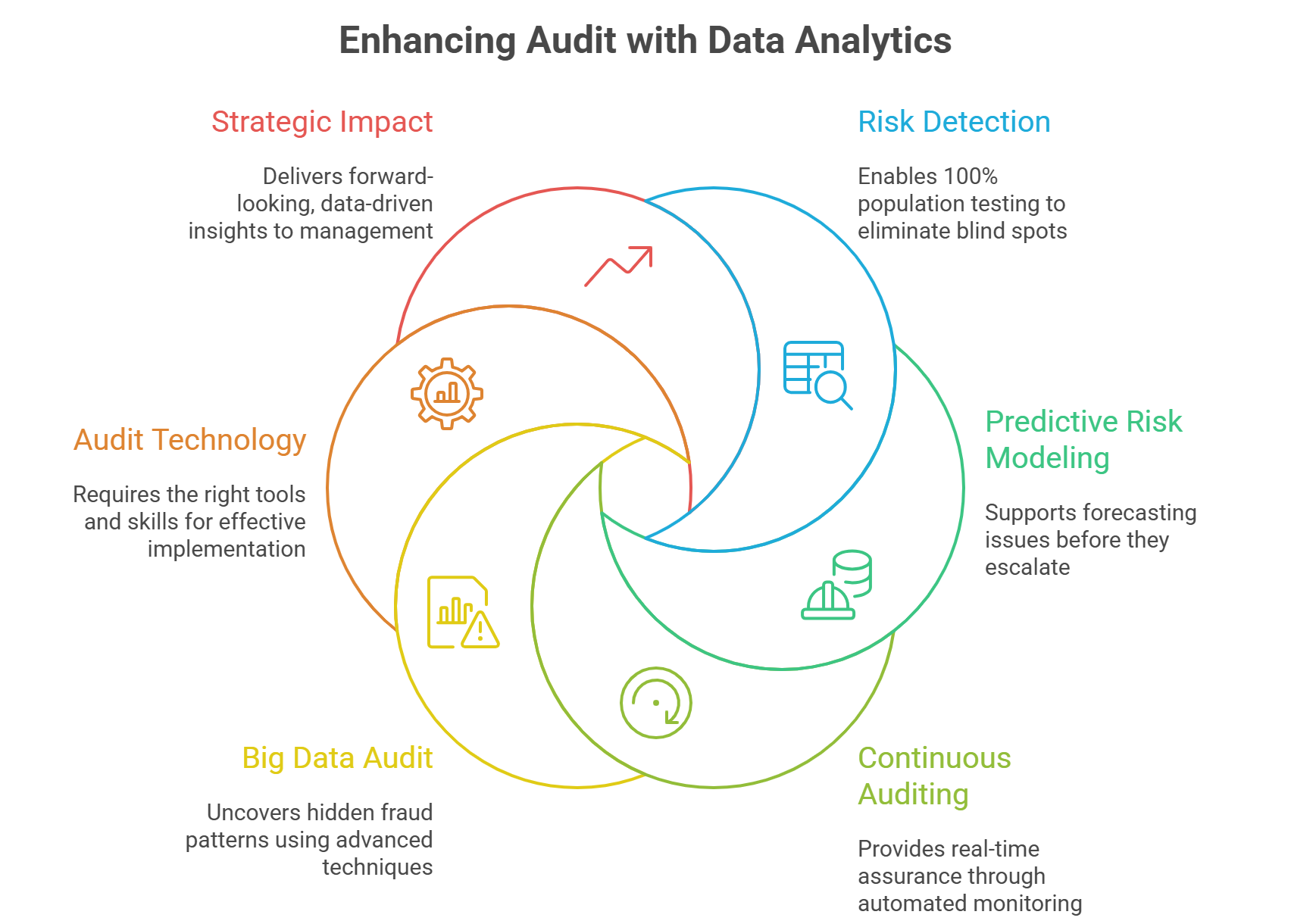

- Data Analytics in Audit enables 100% population testing, eliminating sampling blind spots and improving Risk Detection.

- Internal Audit Analytics supports Predictive Risk modeling, allowing auditors to forecast issues before they escalate.

- Continuous Auditing provides real-time assurance through automated monitoring and alerts, moving beyond point-in-time reviews.

- Advanced techniques like anomaly detection and machine learning uncover hidden fraud patterns and control gaps in Big Data Audit environments.

- Effective implementation requires the right Audit Technology, skills, and change management to deliver strategic impact.

- Internal audit can become a true business partner by providing forward-looking, data-driven insights to management and the Audit Committee.

Why Internal Audit Must Move Beyond Sampling

Traditional internal audits often rely on sampling—reviewing a small subset of transactions or records. While this approach has been standard for decades, it creates significant blind spots. Sampling can miss rare but high-impact events like fraud, errors, or control failures that occur infrequently but have material consequences.

With Data Analytics in Audit, internal auditors can analyze 100% of the population instead of a sample. This shift from sampling to full-population testing dramatically improves Risk Detection coverage. For example, anomaly detection algorithms can flag unusual journal entries, duplicate payments, or transactions just below approval thresholds across millions of records in minutes.

Consider a large financial institution that used analytics to review all its journal entries instead of a 5% sample. The analysis uncovered a pattern of round-dollar entries and after-hours postings that manual testing had missed. This led to the discovery of a manipulation scheme that had been ongoing for over a year. Such cases highlight the limitations of sampling and the power of Big Data Audit techniques.

A unique insight: many organizations still treat analytics as an “add-on” to traditional audits. The real transformation happens when analytics becomes the default starting point. Begin every audit with a data-driven risk assessment. Use descriptive and diagnostic analytics to understand what happened and why, before designing targeted tests. This approach not only improves coverage but also increases stakeholder confidence in the audit function’s ability to detect material issues.

From Reactive to Proactive: The Role of Predictive Risk

Predictive analytics is changing how internal auditors approach risk. Instead of only identifying issues after they occur, auditors can now forecast where problems are likely to emerge. This is the essence of Predictive Risk in internal audit.

By applying statistical models and machine learning to historical data, auditors can predict future outcomes. For instance, regression analysis can forecast cash flow trends, while classification models can risk-rate purchase orders or vendor invoices. Time series forecasting helps anticipate seasonal spikes in certain types of transactions, which can then be monitored more closely.

In one case, a multinational corporation used predictive analytics to identify suppliers with a higher likelihood of invoice discrepancies based on past patterns. The model considered factors like invoice frequency, payment timing, and historical error rates. This allowed the audit team to focus their testing on high-risk vendors, significantly increasing the efficiency and effectiveness of the procurement audit.

A key point often overlooked: predictive models are not just for financial audits. They can be applied to operational, compliance, and IT audits as well. For example, predictive analytics can forecast potential IT control failures or compliance breaches based on system logs and user behavior patterns. This enables auditors to provide early warnings to management and support proactive remediation.

Building Predictive Models: Practical Steps for Internal Auditors

Start by identifying a specific risk area where historical data is available and where early detection would add value. Common candidates include accounts payable, revenue recognition, and IT access controls. Next, gather clean, structured data from relevant systems such as ERP, payroll, and procurement platforms.

Use simple models first—like logistic regression or decision trees—before moving to more complex machine learning algorithms. Validate the model against known outcomes and refine it iteratively. Finally, integrate the model into the audit planning process so that high-risk areas are automatically flagged for deeper review.

Continuous Auditing: From Point-in-Time to Real-Time Assurance

Traditional audits are typically point-in-time exercises, conducted quarterly or annually. Between audits, risks can emerge and escalate without detection. Continuous Auditing changes this by embedding automated tests and monitoring into business processes.

With Audit Technology such as AI-powered analytics platforms, internal auditors can set up continuous transaction monitoring rules. These rules automatically flag suspicious activities as they occur—such as duplicate payments, unauthorized access attempts, or transactions outside normal parameters. This enables real-time Risk Detection and faster response times.

For example, a retail company implemented continuous auditing for its store-level cash handling processes. Automated rules monitored daily cash deposits, refunds, and voids. When the system detected a store with unusually high void rates and frequent manager overrides, the audit team was alerted immediately. An investigation revealed a collusion scheme between staff and customers, which was stopped before significant losses occurred.

A unique perspective: continuous auditing is not just about technology. It requires a cultural shift in how audit teams operate. Auditors must move from being periodic reviewers to ongoing monitors and advisors. This means redefining roles, updating skills, and aligning with business units to ensure timely follow-up on alerts.

Designing Effective Continuous Monitoring Rules

Effective continuous monitoring starts with well-defined risk scenarios. For each key process, identify the types of errors or fraud that could occur. Then, translate these into specific, measurable rules that can be automated.

Common rules include: transactions just below approval limits, round-dollar amounts, after-hours entries, and unusual patterns in user access or system changes. These rules should be risk-based, focusing on areas with the highest potential impact or likelihood of failure.

It’s also important to avoid alert fatigue. Too many false positives can lead to important signals being ignored. Regularly review and refine rules based on actual findings and changing business conditions. This ensures that the monitoring remains relevant and effective over time.

Integrating Continuous Auditing into the Audit Lifecycle

Continuous auditing should not exist in isolation. It must be integrated into the end-to-end audit lifecycle. Use continuous monitoring outputs to inform audit planning, risk assessments, and testing strategies.

For instance, if continuous monitoring consistently flags issues in a particular business unit or process, that area should receive higher priority in the annual audit plan. Similarly, findings from continuous audits can be used to update risk registers and control frameworks, creating a feedback loop that strengthens the overall control environment.

Enhancing Risk Detection with Advanced Audit Analytics

Modern Internal Audit Analytics goes far beyond basic queries and filters. It includes advanced techniques like anomaly detection, clustering, and network analysis that can uncover hidden patterns and relationships in data.

Anomaly detection, for example, identifies transactions or behaviors that deviate significantly from the norm. This is particularly useful for fraud detection, where perpetrators often try to stay just below detection thresholds. Clustering can group similar transactions or vendors, helping auditors identify outliers that warrant further investigation.

In a procurement audit, an organization used clustering to group suppliers by payment patterns, invoice frequency, and relationship to employees. The analysis revealed a cluster of suppliers with unusually similar characteristics and payment timing, which led to the discovery of a shell company scheme. This type of insight is difficult to achieve with manual methods or simple sampling.

A less-discussed but critical point: advanced analytics must be paired with strong data governance. Poor data quality, inconsistent coding, or lack of access to key systems can severely limit the effectiveness of even the most sophisticated models. Internal auditors should advocate for clean, standardized, and accessible data as a foundational requirement for effective analytics.

Using AI and Machine Learning for Fraud Pattern Recognition

AI and machine learning are transforming Risk Detection in internal audit. Unsupervised learning algorithms can uncover unknown fraud risks and process failures by identifying unusual patterns in large datasets.

For example, machine learning models can detect subtle correlations between seemingly unrelated transactions, such as a series of small payments to different vendors that, when combined, exceed approval limits. These patterns are often invisible to manual review but can be flagged automatically by AI-powered analytics tools.

Generative AI is also emerging as a tool for accelerating fraud-focused innovation. It can help auditors simulate potential fraud scenarios, generate test cases, and even draft initial findings and recommendations, freeing up time for deeper analysis.

Big Data Audit: Scaling Analytics Across Complex Environments

In large organizations, data is often scattered across multiple systems, formats, and geographies. Big Data Audit involves integrating and analyzing this diverse data to gain a holistic view of risk.

Techniques like data blending, entity resolution, and real-time streaming analytics allow auditors to connect dots across systems. For instance, linking HR data with procurement data can help identify conflicts of interest, such as employees approving payments to vendors they are related to.

To scale effectively, internal audit functions should invest in scalable analytics platforms and develop cross-functional data skills. This enables them to handle the volume, velocity, and variety of modern business data while maintaining audit quality and independence.

Implementing Audit Technology: A Practical Roadmap

Adopting Audit Technology is not just about buying software. It requires a structured approach that aligns with the organization’s risk profile, resources, and strategic goals.

Start with a clear vision: what does success look like? Is it faster audits, better fraud detection, or more strategic insights for management? Use this vision to define specific objectives, such as reducing manual testing by 50% or increasing coverage of high-risk transactions to 100%.

Next, assess current capabilities. Evaluate the team’s data skills, existing tools, and access to key data sources. Identify gaps and prioritize initiatives that deliver quick wins while building toward longer-term capabilities. For example, begin with automating repetitive control tests before moving to predictive modeling.

A practical insight: many organizations underestimate the importance of change management. Successful implementation requires buy-in from leadership, collaboration with IT and business units, and ongoing training for audit staff. Position analytics as an enabler of better assurance and business performance, not just a technical upgrade.

Building the Right Team and Skills

Effective use of Data Analytics in Audit requires a mix of technical and business skills. Auditors need to understand data, analytics tools, and business processes. They also need strong communication skills to explain findings and recommendations to non-technical stakeholders.

Consider creating a dedicated analytics team or center of excellence within internal audit. This team can develop standardized methodologies, maintain models and dashboards, and provide support to other audit teams.

Invest in training programs that build data literacy across the function. Topics should include data querying, visualization, basic statistics, and the use of analytics software. Encourage collaboration with data scientists and IT professionals to leverage their expertise while maintaining audit independence.

Measuring the Impact of Audit Analytics

To justify investment in Internal Audit Analytics, it’s essential to measure and communicate its impact. Track metrics such as time saved on manual testing, number of issues detected, reduction in sample sizes, and stakeholder satisfaction.

For example, one organization reported a 90% reduction in manual audit processes after implementing AI-powered analytics, while achieving 100% transaction analysis in key areas. These tangible results helped secure ongoing support from the CFO and Audit Committee.

Also measure qualitative benefits, such as improved risk coverage, earlier issue detection, and increased strategic input to management. Use these insights to refine the analytics strategy and demonstrate the evolving value of internal audit.

Strategic Impact: From Compliance to Business Partnership

When internal audit leverages Predictive Risk and Continuous Auditing, it moves beyond compliance checking to become a true business partner. This shift is increasingly expected by CFOs and Audit Committees.

By providing forward-looking insights, auditors can help management anticipate and mitigate risks before they escalate. For example, predictive models can highlight potential financial shortfalls, operational bottlenecks, or compliance gaps, enabling proactive decision-making.

Audit findings become more actionable when supported by data. Instead of just saying “a control is weak,” auditors can show the frequency, impact, and root causes of control failures, backed by transaction-level evidence. This strengthens credibility and increases the likelihood of management taking corrective action.

A unique angle: internal audit can use analytics to support strategic initiatives, such as mergers and acquisitions, digital transformation, or new market entry. By analyzing data from target entities or new systems, auditors can provide early risk assessments and help shape implementation plans, adding value beyond traditional assurance.

Engaging the Audit Committee and CFO

Audit Committees and CFOs are increasingly focused on risk and performance. Internal audit can meet this demand by presenting data-driven insights in a clear, concise manner.

Use dashboards and visualizations to show trends, risk hotspots, and the impact of audit recommendations. Focus on business outcomes—such as reduced losses, improved efficiency, or enhanced compliance—rather than just technical details.

Regularly update stakeholders on how Audit Technology is improving coverage, speed, and quality. This builds trust and positions internal audit as a forward-thinking, value-adding function.

Enabling Dynamic Risk Assessment Models

Static risk assessments quickly become outdated in fast-changing environments. Dynamic risk assessment models use real-time data and analytics to continuously update risk ratings.

For example, a model might adjust the risk rating of a business unit based on changes in transaction volumes, error rates, or external market conditions. This allows internal audit to adapt its focus and resources in response to emerging risks, rather than sticking to a fixed annual plan.

Dynamic models support more agile and responsive audit planning, aligning the function more closely with the organization’s evolving risk landscape.

Conclusion

The future of internal audit lies in leveraging Data Analytics in Audit to deliver predictive insights and real-time Risk Detection. By adopting Internal Audit Analytics, Predictive Risk models, and Continuous Auditing, audit functions can move beyond retrospective analysis to proactive, continuous assurance.

Modern Audit Technology and Big Data Audit capabilities enable auditors to analyze entire populations, detect anomalies, and forecast emerging risks. This not only improves audit quality but also increases the strategic value of internal audit to the organization.

For internal auditors, Audit Committee members, risk professionals, and CFOs: now is the time to act. Assess your current analytics maturity, define a clear roadmap, and invest in the right tools and skills. Position internal audit as a forward-thinking, data-driven function that helps the organization anticipate and manage risk more effectively. Start small, scale fast, and make analytics the foundation of your assurance approach.

How is your internal audit function using Data Analytics in Audit and Continuous Auditing? What challenges are you facing in adopting Predictive Risk and Audit Technology? Share your thoughts in the comments below!

If you found this article helpful, please share it with your network—especially fellow internal auditors, risk professionals, and Audit Committee members. Let’s keep the conversation going on how to make internal audit more predictive, proactive, and impactful.

References

Insightss. “How to Improve Risk Detection in Internal Audits Using Data Analytics.” https://uk.insightss.co/internal-audits-using-data-analytics/

MindBridge AI. “Data Analytics in Internal Audit: The Next Evolution of Risk Management.” https://www.mindbridge.ai/blog/data-analytics-in-internal-audit-the-next-evolution-of-risk-management/

Supervizor. “The Complete Guide to Audit Analytics.” https://www.supervizor.com/blog/complete-guide-audit-analytics

Plantemoran. “AI and Internal Audit: A Partnership for Precision and Proactivity.” https://www.plantemoran.com/explore-our-thinking/insight/2025/07/ai-and-internal-audit